KCA wins “The Investor’s Podcast” stock pitch competition: AMRK

We are thrilled to announce that KCA was awarded FIRST PLACE in a stock pitch competition hosted by The Investor’s Podcast. Our pitch is included below:

A-Mark Precious Metals (AMRK)

The rise (and perhaps fall) of the crypto industry has reignited the debate around the intrinsic value of various assets. However, utilizing precious metals as a store of value dates back thousands of years. In fact, it is believed the first use of gold as money occurred in 700 B.C. What if investors could benefit from this asset class with a multi-millennia track record, without exposure to the price volatility of the asset itself? And what if the target investment was selectively rolling up their industry for ~1x EBITDA?

A-Mark Precious Metals (AMRK)

A-Mark is a vertically integrated precious metals dealer, primarily selling gold and silver bullion, and trading at 3 times cashflow. The Company has both wholesale and Direct-to-Consumer (DTC) channels, where it charges a premium to the physical price of gold and silver products. Additionally, the company monetizes ancillary services like storage and lending. A-Mark completely hedges their inventory to eliminate price exposure (Exhibit 1 shows only $7.2m of their $674.8m inventory at Sep-22 was subject to price risk.) Therefore, investors benefit from the business of selling precious metals, without exposure to the volatility of the underlying asset.

A-Mark is rolling up the fragmented DTC bullion industry. Supply for minted metal is increasingly scarce, and A-Mark is leveraging their supply advantages to complete extremely advantageous acquisitions of peers who lack product. How advantageous you ask? A-Mark acquired JM Bullion in 2021 at a valuation of ~173m (actually paid $138.3m for the 80% they didn’t already own). In their first full year of ownership, JMB EBITDA exceeded $100m.

We believe this investment opportunity exists due to unpredictable cash flow quarter to quarter and perceptions that A-Mark cannot sustain the current earnings trajectory.

A-Mark Business Units

As mentioned, minted metal is in short supply. Part of A-Mark’s “moat” is their investment in the supply chain. A-Mark owns the Silvertowne Mint and has a 44.9% minority investment in the Sunshine Mint (source of blanks for the US Mint). A-Mark has rapidly expanded production at Silvertowne to meet demand, from 175k ounces/week pre-2020, vs 1m ounces/week today (per Q1-23 conference call). A-Mark sources outside precious metals to fill remaining demand and enjoys strong relationships with the major sovereign mints (US Mint, Royal Canadian, Perth, etc), historically selling 30%+ of the total sovereign product distributed.

A-Mark has three verticals, Wholesale, Direct to Consumer, and Secured Lending.

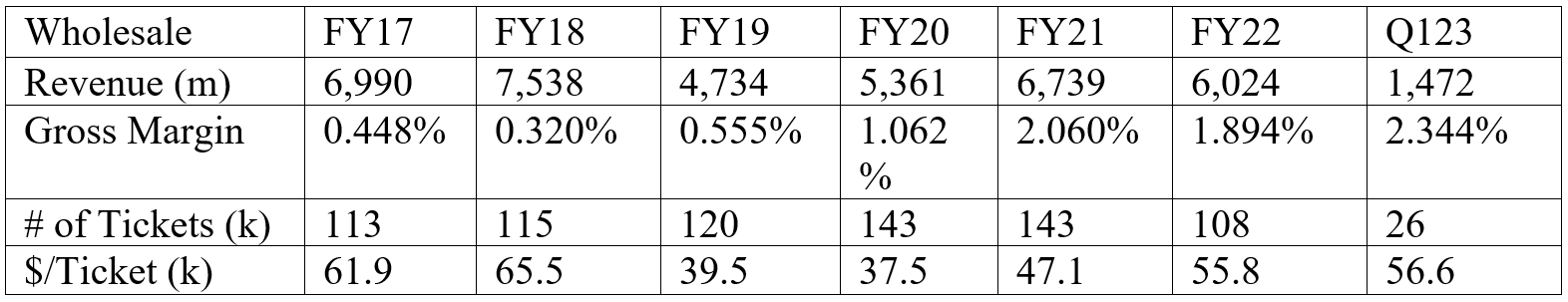

Wholesale - A-Mark sells bullion to institutional clients and retailers - see Exhibit 2 for historic metrics. Margins fluctuate quarter-to-quarter; however, we believe A-Mark’s recent capital allocation has permanently improved wholesale margins.

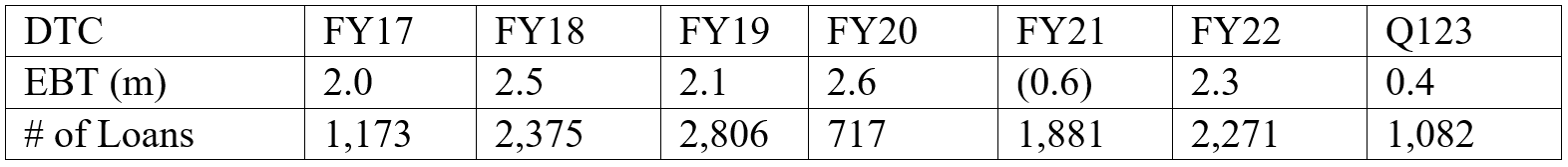

Direct-to-Consumer (DTC) - customers are retail buyers - see Exhibit 3 for historic metrics. Since 2020, the company has acquired and invested in multiple DTC channels to increase and diversify their customer-base.

Goldline - acquired for $10m in 2017. This channel advertises heavily on FOX NEWS / FOX Business (Glen Beck is spokesman) and targets higher net worth retirees. Predictably, this business does best in times of political tension.

JMBullion - the remaining 80% of the mass market platform was acquired for $138m in 2021 (JMBullion, Provident Metals, Silverprice.org, Goldprice.org, Silver.com). The typical retail customer for this business is younger and buys in smaller size than Goldline. This is the largest US retail platform with APMEX as the main competitor.

Silver Gold Bull - a recent minority acquisition to expand sales primarily in Canada and Southeast Asia, with option to boost ownership to 75% in 2024. Sales outside of the US and Europe represented ~11% of FY22 revenue, suggesting international growth could be material.

Pinehurst - additional minority stake which primarily sells graded coins to collectors at substantial premiums. They vet the A-Mark inventory to select the best pieces and capture the highest value.

Buy Gold and Silver Coins - acquired in October 2022 after Management indicated they received a bargain price as the owner was seeking to exit the business. The platform targets a more price-sensitive consumer.

Secured Lending - originates and acquires loans to dealers, investors, and collectors backed by bullion. The company has extended over $300m of loans since inception without a single loss of principle - see Exhibit 4 for historic operating metrics.

Capital Allocation

Entering the DTC business was a transformational and extremely profitable move for A-Mark. To this end, the $10m investment in Goldline (2017) and the $138.3m buyout of JMBullion (2021) has generated $150.8m cumulative EBT from their DTC unit, essentially 100% ROIC on a segment that has just reported $28.4m EBT in Q1-23 and shows no signs of slowing down.

How do we know the business has transformed, especially given management’s commentary that earnings are best in a volatile precious metals market?

From Jul–Dec 2019, A-Mark Wholesale margins were 0.5%.

From Oct–Dec 2020, volatility was higher, and margins increased to 0.9%.

From July–Dec 2021, Gold and Silver volatility was almost identical to the 2019 period, yet Wholesale margins did not revert to 0.5%, instead they were nearly 4x stronger at around 2.0%.

See Volatility charts in Exhibit 5

The fundamental difference is explained by A-Mark’s acquiring JMBullion in early 2021. JMBullion increased DTC volumes and provided a large channel to move wholesale product. Owned mint production also increased and the supply increases JMB’s pricing power over peers. With ~20% of wholesale volume now moving through their internal DTC segment, A-Mark can also be more selective on wholesale counterparts, permanently improving margins.

Management takes a holistic view of business driven to the other channels because of their acquisitions, first articulated after the Goldline acquisition (Greg Roberts, Q2-20 conference call):

“If you factor in all of the business that Goldline is doing on its own as well as what we call cross benefits between the units, whether it be logistics, whether it be trading, whether it be CFC, finance, I think that if we look at -- we and management tend to look at Goldline macro as to how it affects the whole business and the benefits that some of the other business lines are getting from having Goldline.”

The latest example is the $4.5m acquisition of Buy Gold and Silver Coins (BGASC) in October 2022. BGASC has 120,000 customers and over $200m in FY21 sales. Management expects this will be a slightly lower margin customer than JMBullion, but even 5% gross margins as part of the A-Mark model would suggest the payback occurs in about 6 months, not years. BGASC was also not an existing wholesale customer, adding even more synergy to the acquisition. Per the Q1-23 call, BGASC is already exceeding expectations.

A-Mark has created an ecosystem of businesses that benefit from each other through their increased access to product, internal synergies, and cross-selling, which creates a wide moat in a DTC business that will be hard to assail. Management has repeatedly stated they are “the acquirer of choice” for retail targets, giving them the ability to continue selectively growing through acquisitions at very attractive multiples. As outlandish as it may seem, A-Mark is selectively rolling up their industry at ~1x EBITDA, and no one seems to care.

Additional Upside

A-Mark is making a play for a much larger piece of the global gold and silver ETF pie by launching Cyber Metals, a platform for users to replace ETF holdings with deposits backed by actual bullion. For many investors, the ability to hold investment dollars in this form versus traditional ETFs is very attractive, giving them the ability to convert to physical product at any time. Company materials point to the $100B+ residing in leading gold and silver ETFs, and trillions in gold and silver assets held globally. Skepticism is in order until they can show a meaningful portion of the market will convert to Cyber Metals: six months after the commercial launch, only $4.6m AUM resided on the platform.

Storage rates are currently 0.12-0.3% per annum, suggesting $1B+ of AUM might be necessary before earnings become material. This product also seems like it would appeal to investors who have flocked to cryptocurrencies in the past decade, providing easy access to a digital asset protected from central bank actions. Meaningful inroads by Cyber Metals with the turbulent crypto market could be very material to A-Mark.

Valuation Approach

Valuing A-Mark is difficult, and no similar comparisons exist. Sales multiples are useless for such a low margin and lumpy business, especially given revenues are a function of commodity inputs (silver and gold). Additionally, the more than $300m of income generated since the beginning of Covid looks like peak earnings, making investors nervous to put any meaningful multiple on recent results.

We believe A-Mark has a strong moat, as working with sovereign mints and dealing bullion requires significant third-party trust that can’t be quickly replicated. A-Mark's access to product both protects their margins and gives them a hefty weapon to wield during acquisition negotiations.

We’ve already highlighted how A-Mark has hallmarks of a great business – their near 100% Return on Invested Capital for DTC investments is rare for a serial acquirer. A-Mark has a stunning 22.7% average Return on Equity, including periods before Covid, highlighting the strength of their business model (see Exhibit 6 by quarter since becoming public).

From an earnings perspective, we believe the core business can comfortably substantiate the current SG&A burden of ~$70-80m with $100m+ of EBITDA power in a normalized environment (See illustration in Exhibit 7).

From an Enterprise Value (“EV”) perspective, A-Mark incorrectly appears less attractive due to the large trading facility and secured notes, both of which screen as debt, but are backed by corresponding assets on the A-Mark balance sheet (inventory and secured precious metals loans). The company screens with a >$1B EV, but I argue you should back out the following:

$63m trading facility, $167m product financing arrangements, and $56m liability on borrowed precious metals, which are backed by $625m of inventory and $49m of metals held under financing arrangements. Therefore, the hedged inventory, which turns over multiple times per quarter, covers the “debt” more than 2.3 to 1.

$98m notes payable are offset by $87m secured loans receivable, reflecting significant declines in metals pricing that recovered into Q4.

After removing these debt amounts and subtracting $64m of cash, at $32/share A-Mark has an EV of $736m, about 7x our normalized EBITDA estimate for the business. Additionally, the business is capital light, requiring almost no CapEx beyond growth acquisitions.

Valuation

Growing platforms in the process of rolling up their sector usually trade at extreme multiples, like popular compounders Pool Corporation (POOL), SiteOne Landscaping (SITE), and more. All display the ability to reinvest capital in their business at a high rate of return. We believe a 20x multiple on normalized FCF would be a fair valuation for such a compounding business. $100m of core earnings after SG&A, adjusted for a 25% tax rate and no material CapEx or interest expense is $75m, or $1.5B at a 20x multiple. Using 25m fully diluted shares, this generates a $60 target price, without credit for upside from future acquisitions or new products like Cyber Metals. Davidson and Northland maintain $57 and $60 price targets on the stock, suggesting this approach is not too aggressive.

In the current state, LTM net income is $152m ($192m EBT), and FCF stands at $257m(!) less than 6x our target valuation. If current market conditions remain favorable, A-Mark should significantly outstrip our earnings estimates and build an even stronger business.

Risks

Insiders historically owned nearly half the business and have been trimming stakes after the stock’s substantial run. This insider selling pressure looks poor on the tape but ignores the >20% ownership remaining in the hands of Management, aligning their interests with shareholders. Director Jess Ravich just bought ~2% of outstanding shares via his controlled holding company, ALJ Regional Holdings (ALJJ).

A-Mark relies on relationships with sovereign mints and large institutional buyers in their wholesale segment to generate profits, including their US Mint relationship that goes back over 35 years (FY22 10-K). Any damage to these core relationships could impair profitability.

Lumpy earnings and cashflow don’t sit well with Wall Street investors, and it may take time for investors to grow comfortable with improvements in margins being structural. CEO Greg Roberts has stated on the Q2-20 earnings call a long-term vision to sell the platform after several years of profitability. A sale process seems the most likely catalyst to re-rate shares, without which they may continue to trade at an optically low valuation.

A-Mark has never reported a material error with their hedging program, but any mistakes with inventory and internal hedges could result in a material loss. For instance, A-Mark recently announced a $1.1m settlement due to a previously-undisclosed complaint from the Commodity Futures Trading Commission. The settlement is not material to the valuation, but a reminder that unforeseen risks could arise.

Conclusion

A-Mark has steadily built a moat through their access to cheap bullion, diverse consumer offerings, and highly accretive capital allocation. Management is well aligned through their ownership stake and has shown great skill in recent acquisitions. Continued growth of the DTC business will move more inventory at higher margins. Their tight ties with sovereign mints protect them from displacement, and recent improvements in margins appear structural in nature. We expect the compounding nature of the business will eventually become clear to investors, re-rating shares in line with similar businesses with wide moats.

Appendix

Exhibit 1) Hedging

Exhibit 2) Wholesale Revenue, Margins, Tickets, $/ticket

Exhibit 3) DTC Revenue, Margins, Tickets, $/ticket

Exhibit 4) Secured Lending metrics

Exhibit 5) Gold & Silver Volatility (https://fred.stlouisfed.org/series/GVZCLS, https://fred.stlouisfed.org/series/VXSLVCLS)