Q3 2025 Investor Letter

Fellow Investors,

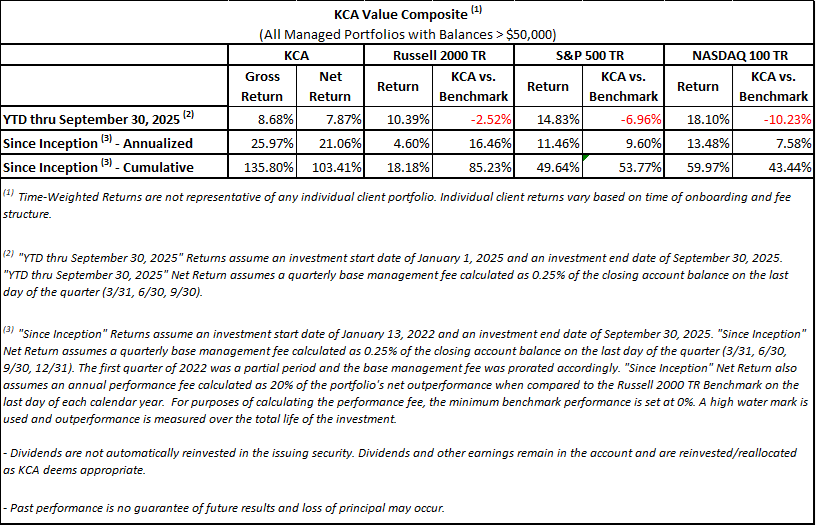

Q3 2025 marked a strong recovery for Kingdom Capital Advisors, with September 30th ranking among the best single-day performances in our firm’s history. Kingdom Capital Advisors (KCA Value Composite) returned 20.78% (net of fees) in the third quarter, vs. 12.39% for the Russell 2000 TR, 8.12% for the S&P 500 TR, and 9.01% for the NASDAQ 100 TR. Returns vary by account due to rounding, account size, and timing of deposits or withdrawals.

Our top Q3 contributors were United Natural Foods (UNFI) and Genesco (GCO). Our largest detractor was WW International (WW).

Portfolio Progress

Three months ago we highlighted KCA’s sustained drawdowns since launching in 2022, with the most recent occurrence – a frustrating combination of tariff vulnerability, key customer losses, and crippling cyber-attacks for our largest positions – resulting in a 15% decline from November 2024 to June 2025. Thankfully, Q3 provided the necessary lift to recover from this significant drawdown. Since inception, we have compounded at 21.06% (net of fees) vs. 4.60% for the Russell 2000 TR, 11.46% for the S&P 500 TR, and 13.48% for the NASDAQ 100 TR.

We maintain our core strategy of seeking market-beating returns in overlooked areas of the market where our research creates genuine informational advantage. Ending Q3, our portfolio is split approximately 50/50 between “special situation” investments and more traditional positions in companies we expect to grow in value in the coming years.

Most of our special situation investments intend to sell undervalued assets within the next twelve months, with upsides ranging from 25% to over 100% of current stock prices. These names receive little fanfare amid wider market surges but serve as ballast to our portfolio in choppy markets.

Our more “traditional” holdings are trading about 10x our estimate of earnings for the coming year, versus almost 30x trailing twelve months earnings. Most trade at a discount to their book value and less than 10x our estimate of cash flow in the upcoming year. We focus on companies where expectations for the coming year(s) significantly underestimate the potential we see in their business and seek to take advantage of those variant views.

Investors frequently ask our views on AI, interest rates, tariffs, EVs, and nuclear power. While we follow these macro trends, they are not where we build investment edge. The best-informed analysts on Federal Reserve policy or Nvidia’s trajectory will always have advantages we cannot match.

Our differentiation comes from exhaustive research on overlooked companies – businesses where few analysts have invested comparable time understanding the operations, management quality, and value catalysts. We focus our energy where deep work creates competitive advantages rather than competing in crowded spaces.

Q3 Performance Deep Dive

We are approaching the two-year anniversary of our initial acquisition of Net Lease Office Properties (NLOP). Since our initial purchase, the company has divested 22 of their 59 properties, repaid all corporate-level debt and paid shareholders a dividend equal to about 20% of our initial cost basis. What’s more, given the properties currently being marketed or under contract (more than half of their 20 largest remaining locations), we expect they will soon pay dividends which reduces our cost basis to zero on those purchases. This investment exemplifies the opportunities we seek to replicate across the portfolio.

We initiated a position in Apartment Investment Management Company (AIV) during the third quarter. The opportunity re-surfaced when the company announced the sale of their Boston multi-family apartment assets, initially sending the stock higher before it declined in the following days. While investors seemed dissatisfied with the sale price on the Boston portfolio, we see this as the clearest signal yet that the company will fully liquidate their remaining properties. We expect most of our invested cash to be returned within a few months given the incoming dividend from the Boston sale, proceeds from their Brickell sale (expected by year end), and the expected sale of their remaining apartment complexes. They still own multi-family units generating about $90m of operating income, and numerous in-progress development sites that we estimate to be worth another $6-7/share on top of the announced transactions.

United Natural Foods (UNFI) exemplifies our approach to developing edge through misunderstood situations. Despite a cyber-attack that paralyzed their distribution network for over 10% of the most recent quarter, management still exceeded sales guidance — demonstrating exceptional execution under pressure. The cyber event appears mostly covered by insurance and has deepened customer relationships rather than strained them. Management's September 30th guidance for the upcoming year shows continued execution well ahead of Wall Street expectations. With $300m of free cash flow expected from operations in FY26, another $150m from cyber insurance proceeds and asset sales, UNFI trades below 6x EV/EBITDA—a persistent discount to peers.

While our ownership was brief, we are thankful to have owned Genesco (GCO). Their May earnings report disappointed investors and the stock traded below $20, representing less than 5x their expected EBITDA for the year. However, while many footwear companies have floundered navigating the current tariff environment, GCO is growing sales through their revised Journey’s concept. GCO also collected a $59m tax refund in Q2 (20% of their valuation at the time) which solidified their strong financial position. The market eventually recognized the value proposition, and we sold our position for over a 50% gain after just a few months.

Similarly, we realized a significant gain on our brief ownership of FG Financial (FGF) in Q3, which lasted for less than a week. The company announced a drastic strategy pivot: spinning out their prior holdings to investors via a contingent value right (“CVR”) and purchasing the Ethereum cryptocurrency as their primary business model while rebranding as “FG Nexus.” The stock has been a chronic underperformer, but after analysis it became clear the value of the CVR was far more than the ~$15 stock price. The market caught up quickly, and we sold the position for nearly double after a few days, happy to secure a sizeable gain and not wait for the uncertainty of a slow liquidation of legacy investments.

We exited Unit Corporation (UNTC) at the end of Q3, despite anticipating a longer holding period when we acquired shares again this year. The stock price approached our conservative estimate of fair value, while underlying fundamentals for U.S. oil and gas producers remain weak. A popular investment blog began promoting UNTC during Q3 and suggesting far higher prices were possible, which we primarily believe was responsible for the share price appreciation. We are happy to take the gain and redeploy into other more undervalued ideas.

Q3 was not without challenges, as several larger positions have not yet reflected improving fundamentals in their share prices:

Our biggest detractor in Q3, WW International (WW) is the successor to the old Weight Watchers entity which filed for bankruptcy earlier this year. We have found post-bankruptcy entities to be historically attractive opportunities, but this one has yet to pay off. We remain intrigued by the growth of their clinical business, though the market seems concerned they will not be able to continue their prior growth after the recent FDA curtailment of GLP-1 compounding. Recent partnerships with Eli Lilly and Novo Nordisk give us some confidence, and the company’s repaired balance sheet gives them some time to navigate the rapidly evolving GLP-1 environment. The avenues for weight loss may have increased, but no other business has a better reputation for addressing behavioral changes needed to maintain a healthy lifestyle.

While less of a drag on Q3, Magnera Corporation (MAGN) stock price remains stuck in neutral. Their business remains stable in the U.S. and Europe, but tariffs have redirected trade flows and pressured their South American business. Management has been proactive on cost takeouts and capacity reductions across their portfolio, and we expect these efforts to shine through when they report their full year results in the coming months. MAGN closed one of their five South American plants, with more rationalization expected to follow. MAGN debt is termed out until 2029, and we expect signs of their business rebound to appear in the coming year’s results. We are happy with Management’s execution and believe the stock price will eventually follow.

Lastly, a.k.a. Brands (AKA) stock price remains stagnant despite tremendous sales growth. The company posted another solid quarter while moving most of their supply chain out of China in the face of new tariffs. Their valuation seems far too low and management continues to outperform their targets. Both the board members and CEO have incentives to increase their stock price from the current $10 level to over $100, the kind of alignment you love to see. Volume on the stock remains very limited, but their strong execution can only go so long before catching some attention.

Two portfolio holdings trade on the expert market with limited public information. SEC regulations prohibit us from purchasing these securities in accounts with balances below $100k. Given the illiquid nature and information constraints of these positions, we maintain appropriately modest position sizes:

Harbor Diversified (HRBR) announced an LOI to sell Air Wisconsin this quarter. While shares trade around $0.75, their last reported quarterly financials showed ~$2/share in cash. We expect eventual proceeds above current prices but remain cautious about timing given limited disclosure.

Venator Materials (VNTRF) exited bankruptcy in 2023 but faces ongoing weakness in Titanium Dioxide markets. Some facilities were placed in administration, while U.K. and Spain locations seek buyers. The situation offers potential upside, but limited disclosure prevents confident assessment. Shares were marked at $6 on extremely limited volume at quarter end.

Both positions were added to our portfolio while trading on conventional exchanges and were sent to the expert market once they became delinquent in meeting financial filing timelines. Due to the limited liquidity of the expert market, there is little opportunity/desire to add to these positions for the time being.

Closing

This quarter I joined Andrew Walker on the Yet Another Value Podcast to discuss our UNFI thesis (https://youtu.be/gQBpphVgir8?feature=shared). The timing proved fortunate—UNFI's stellar September 30th earnings report validated much of our analysis. These discussions help us articulate our investment process and connect with like-minded investors.

Thank you for your patience navigating market volatility and for trusting us to steward your capital. Our focus remains on identifying mispriced securities through differentiated research while managing risk appropriately. As always, please reach out with questions.

Sincerely,

David Bastian

Chief Investment Officer

DISCLOSURES

This document is not an offer to invest with Kingdom Capital Advisors, LLC (“KCA” or the “firm”).

The statements of the investment objectives are statements of objectives only. They are not projections of expected performance nor guarantees of anticipated investment results. Actual performance and results may vary substantially from the stated objectives. Performance returns are calculated by Morningstar.

An investment with the firm involves a high degree of risk and is suitable only for sophisticated investors. Investors should be prepared to suffer losses of their entire investments.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the firm described herein may differ materially from those reflected or contemplated in such forward-looking statements.

This document and information contained herein reflects various assumptions, opinions, and projections of Kingdom Capital Advisors, LLC (“Kingdom Capital Advisors” or “KCA”) which is subject to change at any time. KCA does not represent that any opinion or projection will be realized.

The analyses, conclusions, and opinions presented in this document are the views of KCA and not those of any third party. The analyses and conclusions of KCA contained in this document are based on publicly available information. KCA recognizes there may be public or non-public information available that could lead others, including the companies discussed herein, to disagree with KCA’s analyses, conclusions, and opinions.

Upon request, KCA will furnish a list of all prior securities discussed in our publications within the past twelve months to include the name of each security discussed, the date and nature of each discussion, the market price at that time, the price at which the KCA acted upon the discussion (if at all), and the most recently available market price of each security.

Funds managed by KCA may have an investment in the companies discussed in this document. It is possible that KCA may change its opinion regarding the companies at any time for any or no reason. KCA may buy, sell, sell short, cover, change the form of its investment, or completely exit from its investment in the companies at any time for any or no reason. KCA hereby disclaims any duty to provide updates or changes to the analyses contained herein including, without limitation, the manner or type of any KCA investment.

Positions reflected in this letter do not represent all of the positions held, purchased, and/or sold, and may represent a small percentage of holdings and/or activity.

The S&P 500 TR, Russell 2000 TR, and NASDAQ 100 TR are indices of US equities. They are included for information purposes only and may not be representative of the type of investments made by the firm. The firm’s investments differ materially from these indices. The firm is concentrated in a small number of positions while the indices are diversified. The firm return data provided is unaudited and subject to revision.

None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws, or any other U.S. or non-U.S. governmental or self-regulatory authority. Any representation to the contrary is unlawful.

This information is strictly confidential and may not be reproduced or redistributed in whole or in part.