Q4 2025 Investor Letter

Fellow Investors,

Four years ago, we launched Kingdom Capital with a straightforward thesis: patient capital invested in overlooked microcap companies generates exceptional returns. 2025 tested this thesis more severely than any year since inception and validated it decisively. Despite a bankruptcy filing in the first week of January, a key investment losing major customers in May, and our largest holding suffering a cyber-attack in June, Kingdom Capital delivered 17.45% returns net of fees, demonstrating the resilience of our concentrated, research-intensive approach.

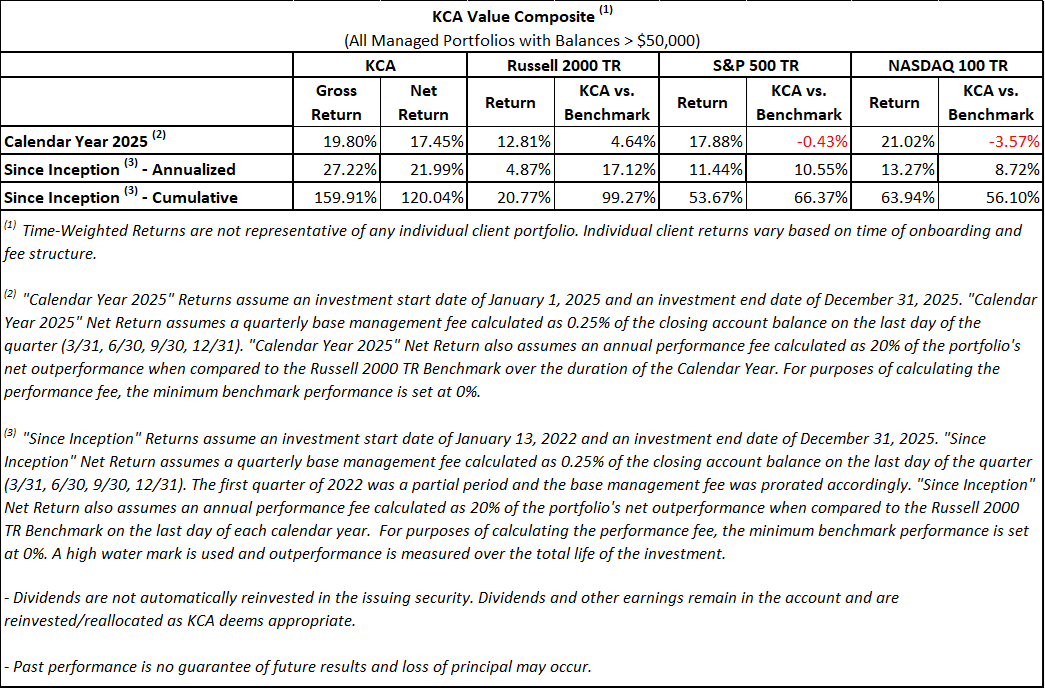

The fourth quarter of 2025 demonstrated strong performance against the major indices. Kingdom Capital Advisors (KCA Value Composite) returned 8.88% (net of fees) in the fourth quarter, vs. 2.19% for the Russell 2000 TR, 2.68% for the S&P 500 TR, and 2.47% for the NASDAQ 100 TR. Since inception in January 2022, we have compounded at 21.99% net annualized versus 4.87% for the Russell 2000, a cumulative outperformance of nearly 100% over four years. Returns vary by account due to rounding, account size, and timing of deposits or withdrawals.

Our top Q4 contributors were Enviri Corporation (NVRI) and Magnera Corporation (MAGN). Our largest detractors were United Natural Foods (UNFI) and Total Site Solutions, Inc. (TSSI). For FY25, our top contributors were UNFI and NVRI, and our largest detractors were Superior Industries (SUP) and Corsa Coal (CRSXF).

2025: Volatility as Validation

2025 delivered the ever-present adversity we must accept as microcap value investors. The most notable challenges included:

Corsa Coal declared bankruptcy during the first week of January, resulting in a complete loss.

Superior Industries lost two key customers in May which accounted for nearly 35% of their total revenue and essentially sent the stock price to zero.

United Natural Foods experienced a cyber-attack in June which paralyzed operations for over a week and sent the stock price down nearly 25%.

Net Lease Office Properties, our largest portfolio position, advanced their liquidation plan and yet the stock had minimal price appreciation in 2025.

Despite these challenges, active management and disciplined position sizing delivered strong annual returns, reinforcing our belief that edge comes from exploiting inefficiency, not avoiding adversity.

We completely exited the Superior Industries position in pre-market trading the morning they announced their customer loss – realizing a 67% loss vs. the eventual 97% loss.

As discussed in prior letters, we made quick, opportunistic trades in GCO, FGF, and STRZ, all of which provided outsized returns.

Once we understood the scope of the cyber-attack at United Natural Foods, we doubled down on our initial position, leaning into conviction, and creating our largest portfolio gains for the year.

Our core strategy remains seeking market-beating returns in overlooked areas of the market where our research creates genuine informational advantages. When popular stocks and themes perform exceedingly well, our strategy requires patience through volatility. Despite significant adverse events, Kingdom Capital delivered strong returns, demonstrating that our edge comes not from avoiding volatility, but from managing drawdowns while capitalizing on opportunities others miss.

Q4 2025: Thesis Validation

Q4 can be summarized across three themes, the first being “realized catalysts”:

NVRI telegraphed, then delivered, a $3B sale of Clean Earth, exceeding their entire enterprise value. We profited from this trade by owning both common stock and short-dated call options, enhancing our returns.

NLOP and AIV continued to sell properties and move toward full liquidation. NLOP has now declared $12.30 of dividends per share in 2025 and should be able to return another $10/share in early 2026 once pending sales close. AIV sold the majority of their remaining stabilized apartments and closed their key Brickell sale in December. We expect dividends in FY26 to fully cover our cost basis on both names.

We noted last quarter our residual position in Harbor Diversified (HRBR), which doubled in Q4 on concrete news about their plan to sell their remaining assets for over $100m. Even after doubling, the stock continues to trade near half of our estimate of their current liquidation value.

The second theme in Q4 was our “turnaround” stocks rewarding patience:

After being year-to-date detractors, Magnera (MAGN) and WeightWatchers (WW) both contributed positively to our fourth quarter returns. Both companies reported earnings roughly in-line with our expectations, and the result was a “relief rally” of sorts in their shares. While both were overall detractors in 2025, we maintain a constructive view which we expect will be validated in 2026.

The final theme was “temporary setbacks”:

Despite UNFI's December investor day where management laid out their path to $800M EBITDA by FY28, the stock pulled back on weakening investor sentiment. Presumably, some investors were hoping to hear more details around long-term capital allocation. We view this as temporary noise relative to their fundamental progress, and we were satisfied that UNFI subsequently pointed towards prioritizing stock buybacks after debt paydown progresses.

TSSI stumbled through their November earnings report, vastly underperforming expectations of a significant revenue ramp at their new Texas location. Despite the stock selling off over 50%, the only real issue appears to be a few months’ delay in ramping their operations to Dell’s standards. The company confirmed that volumes have subsequently hit record highs, and we are hopeful for an obvious rebound trade in 2026.

Positioning for 2026

We enter 2026 with high conviction across our concentrated portfolio. Approximately 40% of our capital is allocated to special situations with clear 12-month catalysts:

NLOP and AIV expect to return substantial capital to shareholders as property sales finalize. We anticipate receiving dividends equal to or exceeding our entire cost basis in both positions during H1 2026.

NVRI's Clean Earth sale (expected H1-26) should result in a tax-efficient return of capital distribution.

The remaining 60% of our capital is invested in business trading at significant discounts to our estimation of intrinsic value, which include:

UNFI is on track to trade below 4x EV/EBITDA given management guidance to $800M EBITDA by FY28. Current buyers are paying ~$2B enterprise value for a natural & organic duopoly generating $300M FCF in FY26.

AKA is ramping sales while successfully diversifying supply chain away from China, despite some inventory issues in Q3. Management incentives align at $100+ stock price (currently $11).

MAGN/WW are positioned for margin recovery as operational improvements flow through to earnings.

Our hunting ground remains fertile, with many other interesting companies on our radar that may appear in future letters. The portfolio trades at a conservative multiple to forward earnings with most businesses generating significant free cash flow. We expect that valuation gap, combined with management teams incentivized to unlock value, creates compelling risk/reward regardless of macro conditions.

Personal Updates

The Bastian household was excited to welcome our fourth bundle of joy in October. If anyone has advice for parenting four kids 5 and under, I’m all ears. Mom, baby, and the rest of us are doing well and it has been fun to watch the “big kids” be so excited about having a new baby brother.

One of the main reasons Mike and I started Kingdom Capital was our desire to help friends and family steward their assets well, grow their capital, and make a positive impact for God’s “Kingdom” here on earth. We are reminded how little impact we can have here on earth, when considering our small circle of influence among billions. That said, we wanted to share a couple ways we have found to make a small difference:

I am thankful to serve on the board of Daybreak Ministries here in D.C., which is led by Pastor Jeremy McClain. I can think of no one else I have met with a bigger heart to share the gospel with the Lincoln Heights community, while nurturing children and strengthening families. I am particularly inspired by serving alongside fellow board members that participated in the Daybreak program while growing up in the community. Empowering people who want to continue to serve and better their community is an easy cause to get behind. If you want to hear more about Jeremy’s vision at Daybreak, we recently presented at my church (33-43 minute mark https://www.youtube.com/watch?v=mGTLNxfK2fY).

Kingdom Capital got the chance to sponsor a table at the Central Union Mission anniversary gala recently, which celebrated 140 years of serving the homeless population in D.C. One of the first things that drew me to their model was their focus on providing job training and opportunities to the homeless, providing work on site and partnering with community businesses that share their vision for recognizing the worth that every person has, as an image-bearer of God.

When Shannon and I were adopting our oldest, we got to know Lifesong for Orphans, a nonprofit that provides safe homes for orphans around the world and helps match them with adoptive families. The founders of Lifesong made sure to fund all overhead for the ministry from their other business ventures, ensuring 100% of donor funds are applied to the work Lifesong is performing throughout the world.

Mike traveled to Lithuania this summer to visit with the leaders of City Church (Miesto Bažnyčia) and work with their NextGen team. Lithuania was Soviet occupied as recently as 1990, and City Church is working diligently to plant new churches, care for children with special needs, support Ukranian refugees, and transform the leadership culture of business owners and politicians.

These are just a few of the ways we have found to steward our time and resources, and if you have similar opportunities, we welcome you sharing them with us.

Sincerely,

David Bastian

Chief Investment Officer

DISCLOSURES

This document is not an offer to invest with Kingdom Capital Advisors, LLC (“KCA” or the “firm”).

The statements of the investment objectives are statements of objectives only. They are not projections of expected performance nor guarantees of anticipated investment results. Actual performance and results may vary substantially from the stated objectives. Performance returns are calculated by Morningstar.

An investment with the firm involves a high degree of risk and is suitable only for sophisticated investors. Investors should be prepared to suffer losses of their entire investments.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the firm described herein may differ materially from those reflected or contemplated in such forward-looking statements.

This document and information contained herein reflects various assumptions, opinions, and projections of Kingdom Capital Advisors, LLC (“Kingdom Capital Advisors” or “KCA”) which is subject to change at any time. KCA does not represent that any opinion or projection will be realized.

The analyses, conclusions, and opinions presented in this document are the views of KCA and not those of any third party. The analyses and conclusions of KCA contained in this document are based on publicly available information. KCA recognizes there may be public or non-public information available that could lead others, including the companies discussed herein, to disagree with KCA’s analyses, conclusions, and opinions.

Upon request, KCA will furnish a list of all prior securities discussed in our publications within the past twelve months to include the name of each security discussed, the date and nature of each discussion, the market price at that time, the price at which the KCA acted upon the discussion (if at all), and the most recently available market price of each security.

Funds managed by KCA may have an investment in the companies discussed in this document. It is possible that KCA may change its opinion regarding the companies at any time for any or no reason. KCA may buy, sell, sell short, cover, change the form of its investment, or completely exit from its investment in the companies at any time for any or no reason. KCA hereby disclaims any duty to provide updates or changes to the analyses contained herein including, without limitation, the manner or type of any KCA investment.

Positions reflected in this letter do not represent all of the positions held, purchased, and/or sold, and may represent a small percentage of holdings and/or activity.

The S&P 500 TR, Russell 2000 TR, and NASDAQ 100 TR are indices of US equities. They are included for information purposes only and may not be representative of the type of investments made by the firm. The firm’s investments differ materially from these indices. The firm is concentrated in a small number of positions while the indices are diversified. The firm return data provided is unaudited and subject to revision.

None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws, or any other U.S. or non-U.S. governmental or self-regulatory authority. Any representation to the contrary is unlawful.

This information is strictly confidential and may not be reproduced or redistributed in whole or in part.